Libor to RFR Transition

We can provide support to firms across the various aspects of the Libor transition: Project Management, Risk Analysis, Pricing and Risk Modelling, Financial Impacts, Compliance & Conduct implications, Operational and Legal handling of re-papering (through our network of Legal firms), Clients communication, Technology changes. We partner with Technology firms to offer OCR, Semantic searches, Machine Learning techniques for contextual searches across millions of documents, feeding the results into workflows and documents generation tools to automate the whole re-papering process, particularly key for loans.

OCR

- Machine Learning

Classifying contracts

Digitised documents

Classified contracts, digitised documents using Machine Learning to extract key information from various documents formats and automate analysis and re-drafting of contracts.

Liquidity Risk Framework

Our expertise covers all aspects of Liquidity Risk Management, from Regulatory ratios (LCR, NSFR, 5G) to Stress Testing, Contingency Funding Plan or Intraday Liquidity Risk for Cash AND Securities. We have delivered such projects in Europe and the US, either as consultants or as managers for banks.

- Implemented LCR + NSFR at major EU bank

- Developed Fund Transfer Pricing methodologies for internal liquidity costs recharge

- Built Liquidity Stress Testing for US Bank

Our Fintech partners bring software solutions on problems such as Intraday Liquidity Management.

Liquidity Risk is straddling Front Office Risk and Regulatory Risk Management.

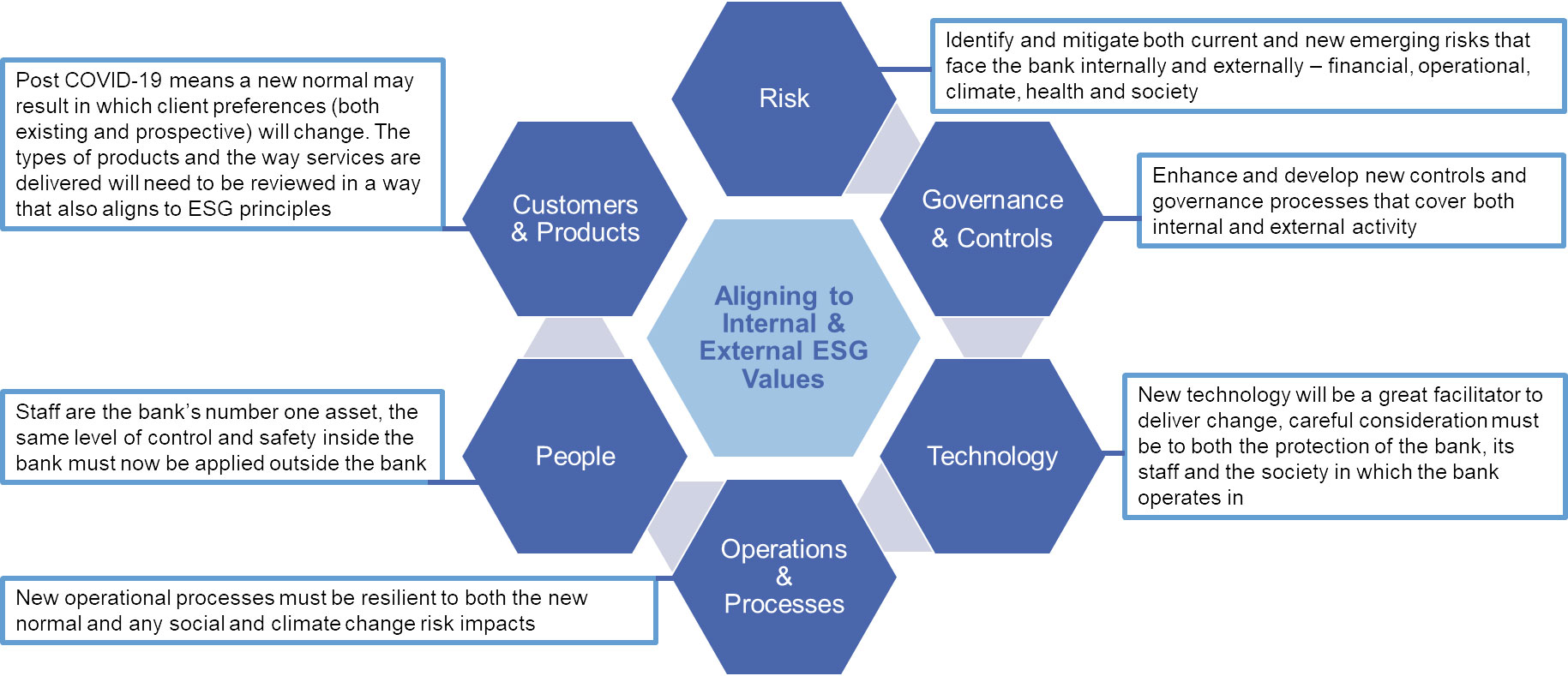

ESG – Climate Change

ESG (Environmental, Social & Governance) issues, particularly Climate Change, are at the forefront of a lot of discussions: regulators lead the charge (eg Mark Carney, the newly created UN Special Envoy on Climate Change) while investors want “green” funds. Risk Management will change radically in the near future to incorporate ESG in all processes, including Credit decisions, RWA calculations and Stress Testing. Our expertise on ESG and Climate Change has been built to incorporate a good visibility and understanding of the Data and Tools offered by Third Parties.

- Consultancy on green projects

Research & analysis on climate change factors within the industry

Climate Change Risk Management

Data input and tooling

Managed project for Japanese think-tank providing research and analysis, preparing advice to local authorities and buy-side institutions on climate change risk management, tooling and required data input.

Entreprise Risk Management

We have delivered multiple projects, from all-encompassing ERM (Entreprise Risk Management) to FRTB, new Credit & Counterparty Risk RWA, very specific Securitisation new capital rules as well as the EU STS classification implementation, well in advance of its applicability.

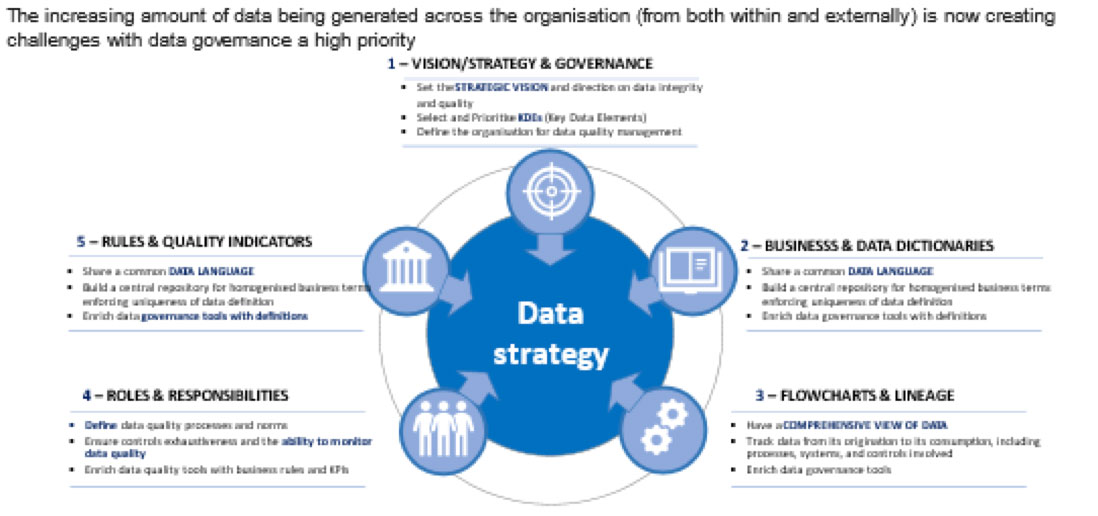

We have expertise in data quality, governance, analytics and reporting:

- Data integration & enrichment

- Risk factor mappings

Vendor selection & TOM

- Centralised policies and procedures

- Model risk management

- Desk-level reporting & independent 3rd party validation (NMRF)

Implemented Basel 2.5 and Basel 3.0 at major EU bank, for Market, Credit & Counterparty and Operational Risks.

Optimised RWA and Stress Test outputs.

Implemented new EU Securitisation capital framework.

Operational Risk Management

A Front-to-Back Operational Risk and Control Framework:

- Inform Policy and Procedures completeness and relevancy

- Ensure forward / backward transparency

- Aggregate controls across dimensions

- Provide Senior Management with assurances and a demonstrable link across Line of Defense controls

- Offer regulatory obligation level taxonomy and classification, linking with a granular regulatory obligation library

- Ensure ability to attest, internally or externally, compliance and good control levels

- Establish confidence and trust with customers, reducing reputation risks

Created and deployed an Operational Risk & Control Framework at several banks (EU, UK, Canada) including a full mapping from Processes, Risks, Controls to Regulatory Obligations and official regulatory texts.

Created KPI report + executive dashboard.

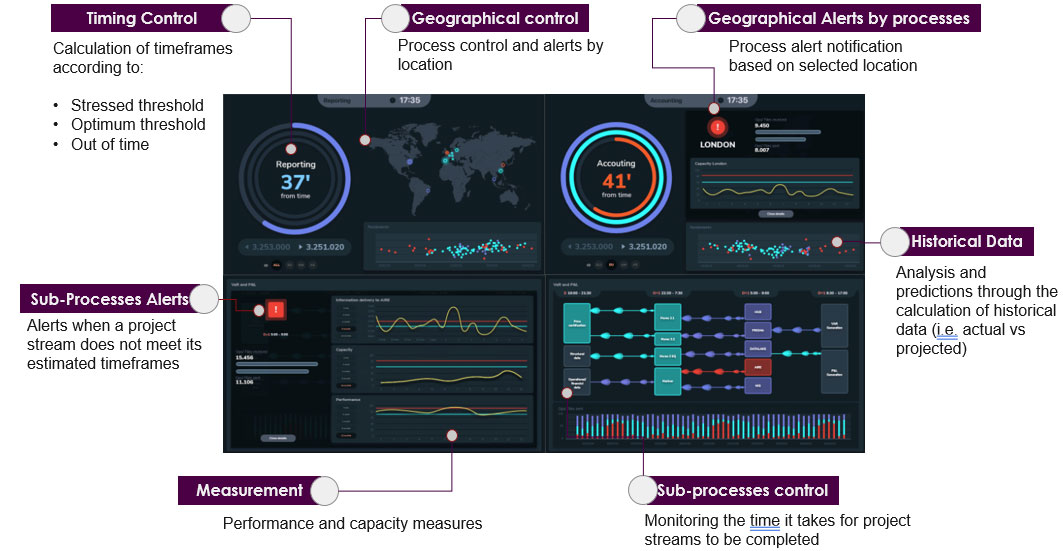

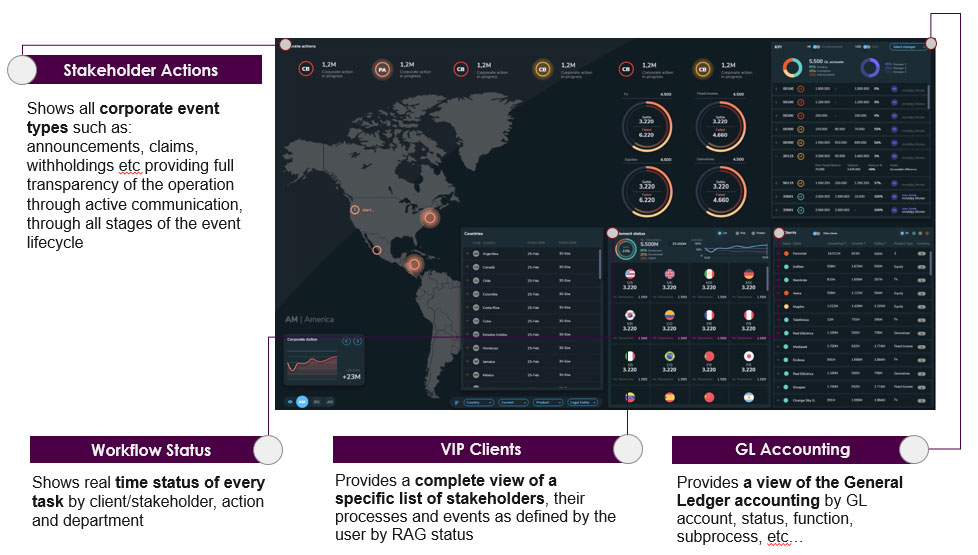

Trades Processing & Reporting

Worked on the implementation of regulations such as EMIR, MiFiD/R II or SFTR in Europe.

Led projects on Dodd-Frank implementation in the US (SEC and CFTC rules).

Worked with an EU CCP to create a new process for clearing equity derivatives across several markets. Designed rulebooks, risk management framework, stress testing rules, VM + IM + Default Fund methodology and backtesting.

Designed processes and IT architecture for Record Management across many jurisdictions (EU, UK, US, Japan, India, Australia…)

Participated in EU regulatory workgroups, direct or indirect feedback (via trade associations) prior to rules finalisation

Implemented EMIR, MiFiD II, SFTR, Dodd Frank programmes

Stay In Touch